change in net working capital meaning

Change in Working Capital. They are commonly used to measure the liquidity of a and current liabilities Current Liabilities Current liabilities are financial obligations of a business entity that are due.

Working Capital Formula And Calculation Exercise Excel Template

The Change in Working Capital is defined as a difference between the two different-period net working capitals.

. This means that for a company with positive net working capital NWC will grow as sales grow and be a use of cash. Because the change in working capital is positive it should increase FCF because it means working capital has decreased and that delays the use of cash. An increase in net working capital means cash outflow and vice versa.

If the change is positive it would mean there is more cash outflow in the form of more current assets. Now Changes in Net Working Capital 12500 9500 3000. Change in Net Working Capital Formula.

In this example net working capital has increased by 3000. Calculations and Meaning 19. Generally a 21 ratio of current assets to current liabilities is considered to be an adequate amount of net working capital.

CHANGE IN NET WORKING CAPITAL NET WORKING CAPITAL FOR CURRENT PERIOD. Examples of Changes in Working Capital. Net Working Capital NWC Current Assets Less Cash Current Liabilities Less Debt Initial formula on top is the broadest which includes all the accounts their next formula is much more narrow and the last formula is the most slim.

Changes in Net Working Capital Working Capital Current Year Working Capital Previous Year Change in a Net Working Capital Change in Current Assets Change in Current Liabilities. A management goal is to reduce any upward changes in working capital thereby minimizing the need to acquire additional funding. So this increase is basically cash outflow for the company.

If your working capital ratio reaches 2 it may indicate a company is sitting on assets and not growing efficiently. How to improve net working capital. Net Working Capital Ratio Current assets Current Liabilities.

Any change in the balances of each line item of working capital from one period to another will affect a firm. Any change in the Net Working Capital refers to the difference between the Net Working Capital of two executive accounting periods. Changes in working capital are reflected in a firms cash flow statement.

Net working capital cash and cash equivalents accounts receivable investments inventory - accounts payable. Means changes in accounts receivable adjusted for non-cash items plus changes in inventory adjusted for long-term and non-cash items less changes in accounts payable adjusted for royalties and rebates. Net working capital which is also known as working capital is defined as a companys current assets minus itscurrent liabilities.

So current assets have increased. Working capital formula. If a companys owners invest additional cash in the company the cash will increase the companys current assets with no increase in current liabilities.

This is a negative event for cash flow and may contribute to the Net changes in current assets and current liabilities on the firms cash flow statement to be negative. 38500 29000. Therefore Microsofts TTM owner earnings come out to be.

Change in the net working capital is the change in net working capital of the company from the one accounting period when compared with the other accounting period which is calculated to make sure that the sufficient working capital is maintained by the company in every accounting period so that there should not be any shortage of funds or the funds should not lie idle in future. Change in Working Capital means for any Excess Cash Period the lesser of i the amount equal to the Working Capital as of the end of such period minus the Working Capital at the beginning of such period and ii 5 of the revenues of the Issuer and its Restricted Subsidiaries excluding Telecom Personal and its Subsidiaries for the last four consecutive fiscal quarters ending on. If a transaction increases current assets and.

Working capital is a measure of both a companys efficiency and its short-term financial health. Define Changes in Net Working Capital. Your working capital ratio is 21 if you have 1 million in current assets and 500000 in current liabilities.

Therefore working capital will increase. Simply put Net Working Capital NWC is the difference between a companys current assets Current Assets Current assets are all assets that a company expects to convert to cash within one year. Net change in Working Capital.

If your working capital ratio is below 1 it may indicate a company is in a risky position. Generally that would be regarded as a healthy ratio but in some industries or types of businesses a ratio as low as 121 may be sufficient. Since the change in net working capital has increased it means that change in current assets is more than a change in current liabilities.

You can use any of the net working capital formula which best suits to your company as well as business. If the difference in the net working capital is negative it would mean that current liabilities have increased more such as an increase in. Current assets Current liabilities Working capital ratio.

Here are some examples of how cash and working capital can be impacted. Heres a couple examples. Since the change in working capital is positive you add it back to Free Cash Flow.

But if sales fall a scenario I worry about as a lender NWC may or may not shrink and free up cash to meet loan obligations. Change in Net Working Capital Formula Example 2. A change in working capital is the difference in the net working capital amount from one accounting period to the next.

18819105991263-13102 19192 34245. It means that the company has spent money to purchase those assets. Plus as revenues rise or fall net working capital tends to stay constant as a percentage of sales.

Working capital is calculated as. How do you calculate change in net operating working capital. Net working capital is defined as current assets minus current liabilities.

The net working capital figure is more informative when tracked on a trend line since this may show a gradual improvement or decline in the net amount of working capital over an extended period. As a business your aim is to reduce an increase in the Net Working Capital. This change in working capital is reflected in the cash flow statements to calculate cash flows from operations.

This is because an increase in the Net Working Capital would mean additional funds needed to finance the increased current assets. Working capital that is equivalent to or higher than the average for a comparable company is good while low working capital could indicate the risk of financial distress or default.

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Change In Net Working Capital Nwc Formula And Calculator

Working Capital Formula And Calculation Exercise Excel Template

Working Capital Cycle Understanding The Working Capital Cycle

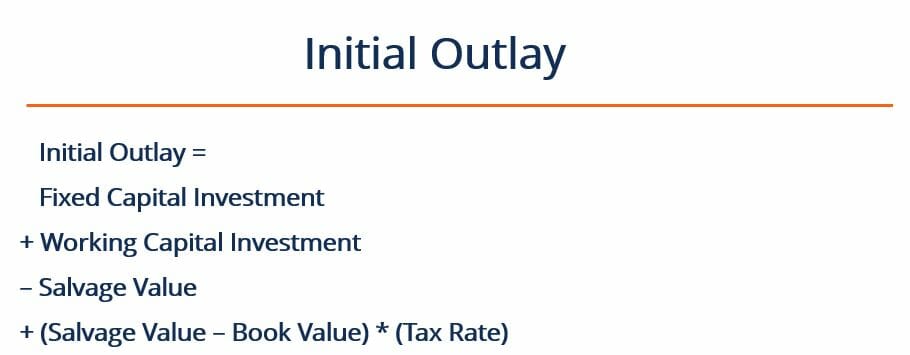

Initial Outlay Definition Explanation And Example Of Initial Outlay

Cash Flow Statement How A Statement Of Cash Flows Works

How Do Net Income And Operating Cash Flow Differ

Working Capital Formula And Calculation Exercise Excel Template

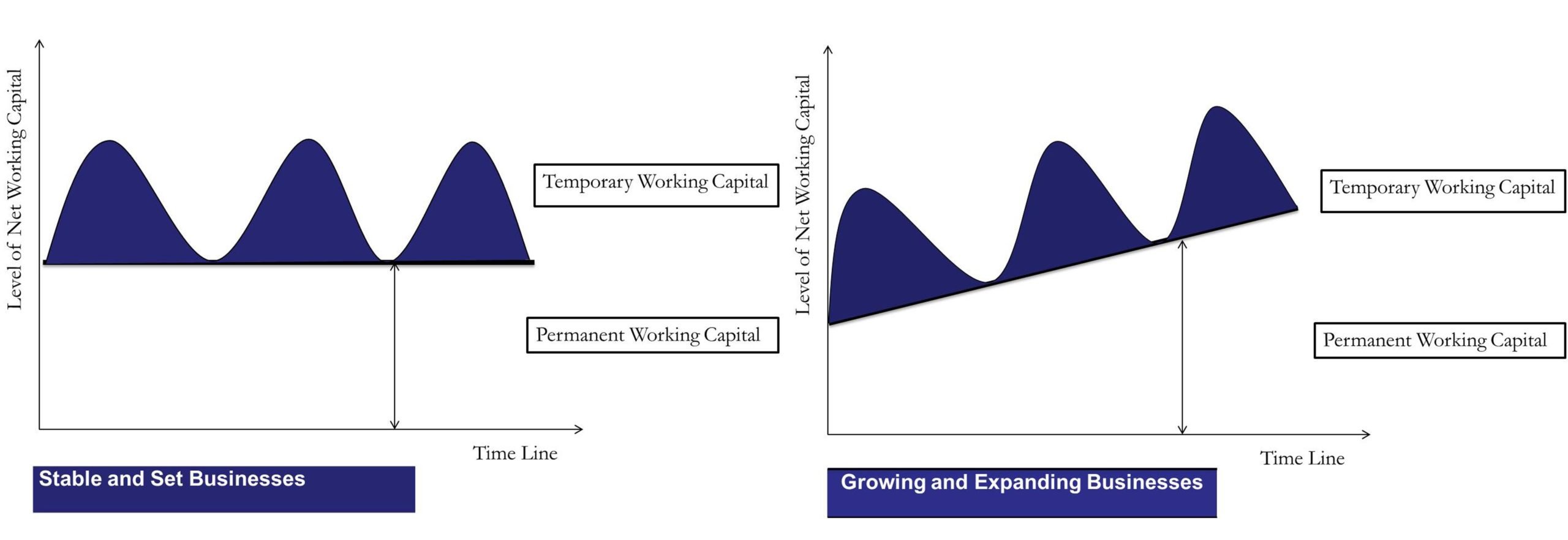

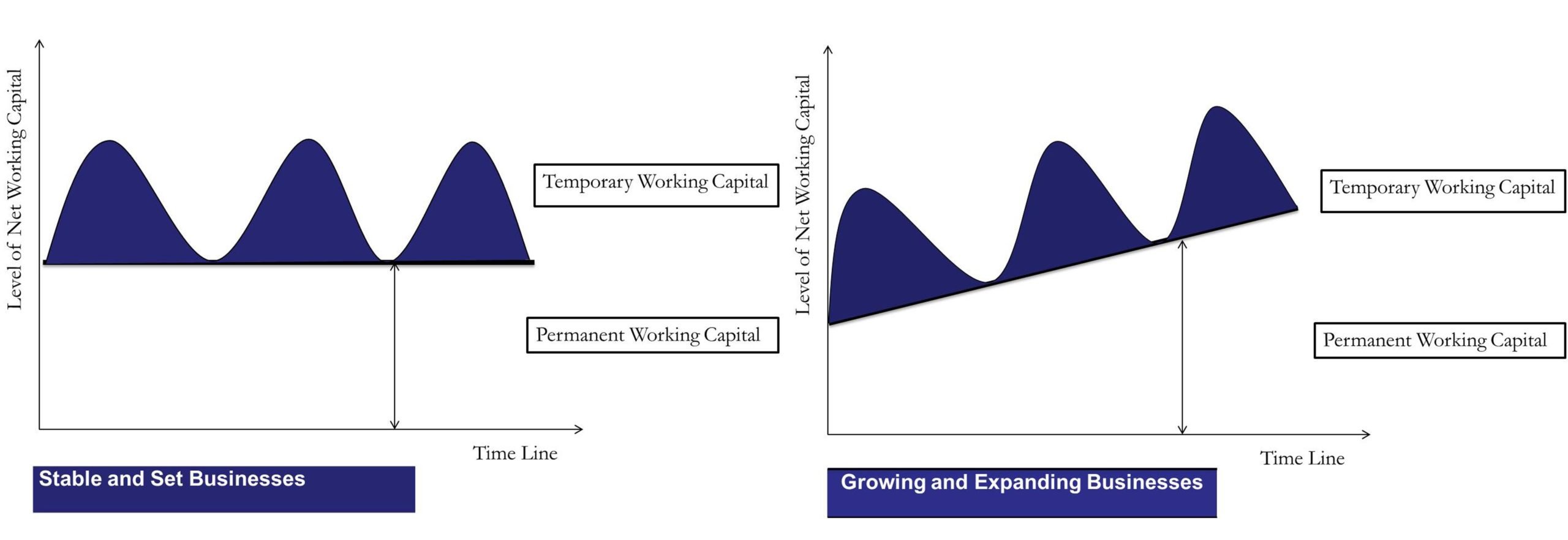

Permanent Or Fixed Working Capital

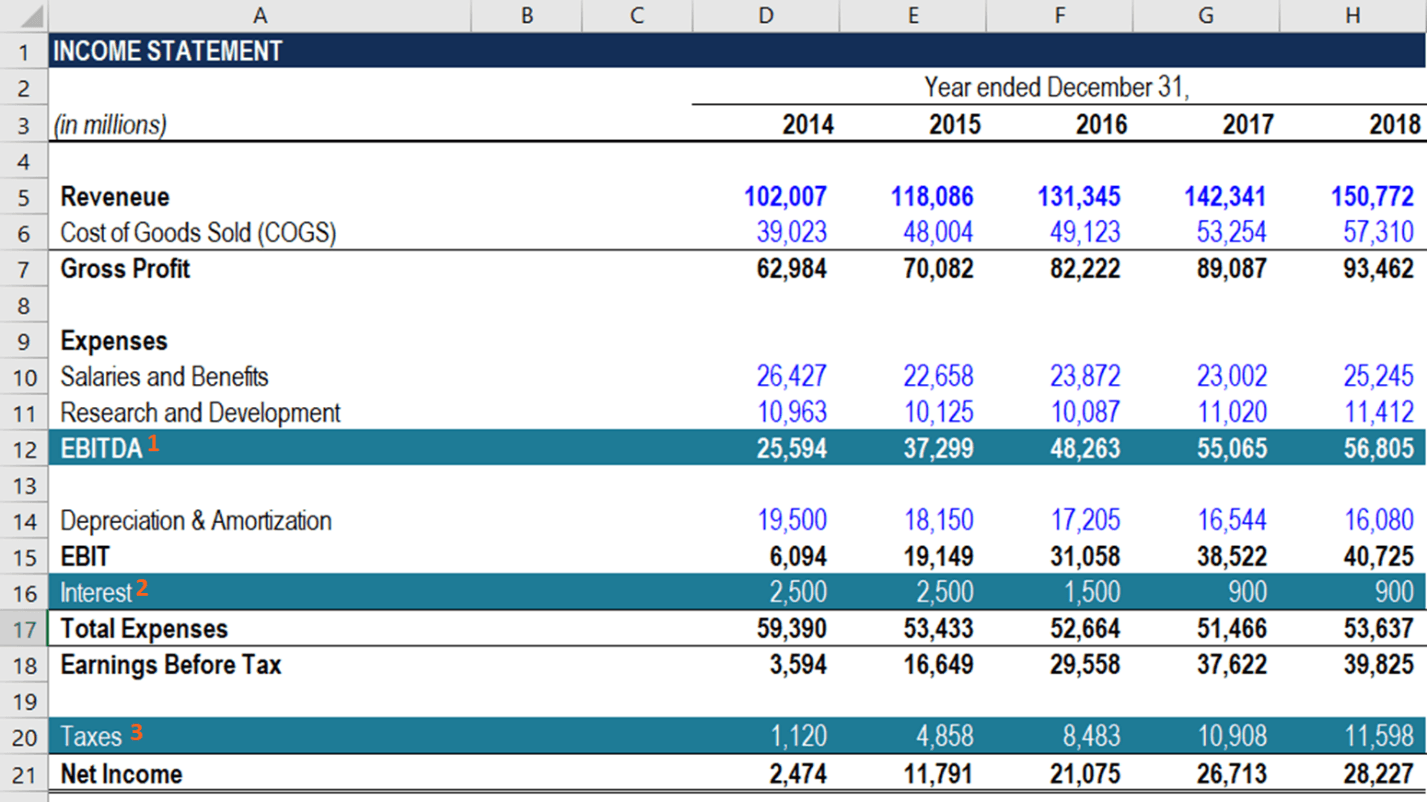

How To Calculate Fcfe From Ebitda Overview Formula Example

Cash Flow Statement How A Statement Of Cash Flows Works

Working Capital Formula And Calculation Exercise Excel Template

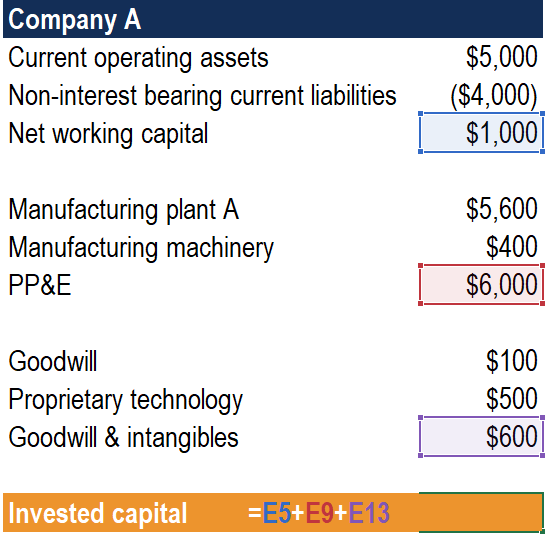

Invested Capital Definition Uses How To Calculate

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)